Product availability is the key issue for brands looking to expand their presence across the fast-paced E-Commerce landscape. With the expansion of new categories that cater to shoppers’ last-minute needs, quick commerce platforms are expanding their horizons. There is a need to measure and monitor stock availability performance across platforms and geographies. Customer loyalty is affected by availability issues as the industry figures suggest that 20-30% of customers may switch to competitors permanently after encountering product unavailability. Also, Tier 2 and 3 cities may face upto 20% more disruptions due to logistical challenges caused by lack of accurate and high-quality availability metrics.

Let’s dive deeper and assess the core issues that brands face on ecommerce and quick commerce platforms. It is important that digital first customer-facing product-oriented brands today understand that reducing out-of-stock occurrences can lead to a lift of revenue by 5-8% with real-time business intelligence and insights.

Table of Contents

ToggleAre you getting the right numbers on e-commerce and quick commerce platforms?

Every quick commerce and e-commerce platform has its own set of challenges, but getting out-of-stock poses a major challenge for brands looking to strike hard at the moment customers is looking for them. This not only puts them out of the race but also lose a loyal customer looking for your brand.

What should brands do to maintain stock availability?

- Keep track of every SKUs in real-time, drill deeper to find out which product is out-of-stock or about to be out-of-stock on which platforms and at which dark store under a pin-code. In-depth analysis and actionable insights are the only way to keep you ahead in this fast-paced race on online shopping platforms.

- A brand stock-out or going out of stock (OOS) can occur due to various reasons like supply shortage, poor inventory management, inaccurate forecasting of demand or unexpected demand surge, etc. The key is digital commerce intelligence on stock availability and real-time alerts on Out-of-stock status.

- The availability monitoring should not be limited, it should be a more granular update such as on certain pin codes where is your product available? Where they stand vs competition? On which platform brand need to stock it up? For instance, a shopper looking for a specific product of the brand might search on multiple platforms as well.

This means brands must monitor their presence across platforms at the pin-code level and on the platform’s dark stores. Here are some key metrics that brands must track within the stock availability monitoring:

- Brand availability trends versus competition

- Availability share versus competition

- City-wise availability trends – monthly, weekly, daily, and hourly

- Platform-wise & geography-wise analysis

- Heat map to identify new geography to target

- Tracking Bottlers’ (Sellers) performance

- Maintaining Out-of-Stock product lists & real-time alerts

This is where mScanIt, digital commerce intelligence comes in handy as it covers all aspects of product availability monitoring across platforms and geographies. Leading brands from FMCG, electronics, beauty and personal categories trust us as it covers more than 150 e-commerce and quick commerce platforms across the world, drilling deeper within city-level analysis along with global coverage of multiple geographies.

Case study:

How a global leader in the beverage industry improved availability across platforms and geographies

Problem Statement

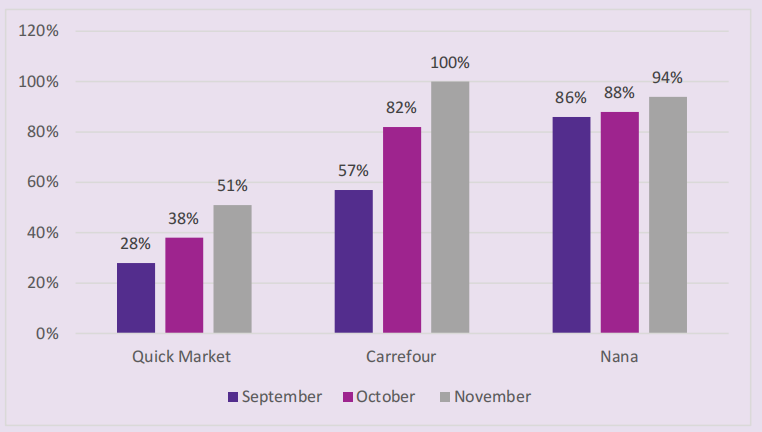

A global leader in the beverage industry faced challenges in ensuring consistent product availability across digital platforms in key AMESA (Africa, Middle East, and South Asia) markets. In September, product availability in the KSA region on prominent platforms like Quick Market, Carrefour, and Nana was inconsistent, reported at:

- Quick Market: 28%

- Carrefour: 57%

- Nana: 86%.

This lack of availability led to:

- Missed sales opportunities

- A weakening of consumer trust and brand loyalty

- Limited visibility in a competitive digital landscape

The company aimed to bolster its market presence by enhancing availability through real-time monitoring, identifying supply chain inefficiencies, and ensuring sellers maintained optimal stock levels.

How mFilterIt helped the brand boost its brand presence to match the competition across geographies

To address these challenges, the company partnered with mFilterIt to implement the Digital Shelf Tracker, mScanIt a cutting-edge solution designed to monitor product availability across multiple platforms and geographies along with other KPIs such as keyword share, product page content, Feedback analysis of rating & review and product pricing and promotions. Here’s how our capabilities lead the way.

- Real-Time Monitoring with Regular updates on product availability and stock levels across Quick Market, Carrefour, and Nana.

- Alerts for out-of-stock (OOS) items, enabling immediate corrective actions.

- Gap Analysis helps identify bottlenecks in the supply chain impacting stock availability.

- Provided detailed insights into seller performance and platform-specific challenges.

- Actionable Recommendations helped develop region-specific strategies to enhance stock levels, such as improving coordination with bottlers and distributors.

- Prioritized high-demand SKUs to maximize availability during peak shopping periods.

- Performance tracking with continuously targeting improvements in availability and visibility.

The results with digital commerce intelligence and shelf monitoring

By the end of November, significant improvements were observed across platforms:

- Quick Market: Availability rose from 28% to 51% (+82%).

- Carrefour: Achieved 100% availability, up from 57% (+75%).

- Nana: Improved from 86% to 94% (+9%).

Fig. 1: Product Availability Across Platforms September to November

These improvements translated into:

- Enhanced customer trust and satisfaction by ensuring products were consistently available.

- Strengthened market share and sales across key platforms, solidifying the brand’s position in the AMESA region.

Through mScanIt, digital commerce intelligence and shelf monitoring – availability analysis, the beverage leader transformed its operational approach, leveraging data-driven insights to achieve exceptional results in a competitive market.

Optimize Customer Journey with Digital Commerce Intelligence

Do not limit to just stock availability tracking! It’s essential to consider various analytical metrics to optimize the customer’s journey across e-commerce and quick commerce platforms. Each stage requires a tailored approach to ensure that the brand’s presence is effectively communicated, and customer engagement is maximized across the digital shelf.

This journey can be optimized at three broad levels with digital commerce intelligence:

Awareness and Interest Stage

Brands must track visibility and ensure that products are accurately featured throughout the marketplace. This phase boosts awareness and drives interest from potential customers.

Key tools for this stage include:

- Discoverability Analysis that tracks the keyword share across organic and sponsored listings across platforms and geolocations.

- Sponsored banner analysis with insight into banner performance, visibility, and theme.

- PDP content analysis and optimization recommendations improving product page content.

- Keep track of new competition across various segment, across sub-categories and product variant across geographies

Consideration & Evaluation Stage

Evaluates crucial elements that influence a customer’s decision-making process. It’s a phase where shoppers evaluate the product, actionable insight at this phase can help brand more dynamic on pricing and optimizing availability.

Key tools for this stage include:

- Pricing and discounting analysis to stay on top of pricing trends versus competition and extensive MAP (Pricing violations) monitoring.

- Content analyzers that help identify gaps in PDP content.

- Customer feedback analysis covers customer ratings, reviews, and Q&A data providing insights into customer sentiment and themes.

- Delivery Turnaround Time (TAT) identify the bottleneck and optimize the delivery time.

Decision/Purchase stage

The focus shifts to performance analysis at a deeper level, such as sales analysis along with comprehensive scorecards and reconciliation at both the brand and category levels.

This helps identify the bestselling and hero products of the brand, offering insights into what drives customer purchases. By analyzing overseas digital shelf performance, brands can refine their strategies to boost their presence and increase sales across international markets.

Conclusion

Fast-pace of e-commerce and quick commerce platforms demand transparency in stock availability. When products go out-of-stock, customers quickly switch to competitors, and it can damage brand loyalty. Monitoring stock status and optimizing presence across platforms makes brands more competitive and it helps build consumer trust.

Our digital commerce intelligence tool mScanIt, enables brands to track stock availability in real-time and identify gaps across various platforms. The data-driven approach allows brands to enhance their digital shelf presence and ensure their products are consistently available in key markets.