The Quick Commerce revolution is reshaping the e-commerce business landscape in the UAE at an unprecedented speed. Convenience and customer-centric services are at the forefront pushing businesses to embrace a rapid online shopping model. As per recent projections by Statista, the Q-Commerce market in the UAE is expected to reach a revenue of $3.27 million in 2024, with a compound annual growth rate (CAGR) of 7.71% from 2024 to 2029. This growth could drive the market volume up to $4.74 million by 2029 with 1.2 million users.

In this competitive landscape local players are building hyper-efficient delivery networks to compete alongside international giants. For brands, staying ahead requires market and competitive intelligence across platforms and geographies. Leveraging advanced tech-stack for Quick Commerce analytics to gauge where they stand compared to rivals, identify gaps, and explore new opportunities is the need of the hour. Today, it is not only helping brands to stay ahead of competition but also growing business and making it more profitable.

Table of Contents

ToggleQuick Commerce in UAE

The Quick Commerce market in the United Arab Emirates is experiencing a surge in demand due to the country’s high population density and fast-paced lifestyle. Understanding the dynamics with Quick commerce analytics and preparing brands for a transformative journey into the future.

Q-Commerce companies like Noon, Talabat, Carrefour etc. typically operate their own “dark stores” or cloud stores, where personal shoppers fulfill online orders, offering fast, last-mile delivery. The market is dominated by grocery and essential goods deliveries, often fulfilled within an impressive timeframe. With a densely populated urban environment and a significant population of expatriates, the UAE is becoming a prime environment for Quick Commerce growth.

Local providers are responding by enhancing app-based ordering and expanding their services beyond grocery items to include pharmaceuticals, home essentials, and even fresh foods.

Local special circumstances: United Arab Emirates has a large expatriate population, many of whom are time-poor and willing to pay for convenience which has created a strong quick commerce market. Additionally, it is fueled by the hot climate in the region, due to which customers are often reluctant to leave their homes to shop.

Quick Commerce Analytics to Lead the Market

UAE’s competitive Quick Commerce landscape requires brands to prioritize performance monitoring through digital commerce intelligence and analytics. Here are some key areas where Quick Commerce analytics help drive product performance vs competitions:

- Track global & local competitors’ products performance vs yours across eCommerce platforms

- Monitor Search of Search and Visibility Share across platforms & locations

- Identify new opportunities -demographics or geographies to target in your market segment

- Set market strategies based on insights & analytics

- Enhance content to suit the local shoppers’ needs by identifying high-performing keywords

What metrics should brands track in Quick Commerce Analytics in UAE

Quick Commerce focuses on ultra-fast delivery, often within an hour or even less. Analytics helps identify any bottlenecks in the process. Real-time actionable insights allow brands to adapt. Monitoring Key KPIs such as pricing, availability, keyword share – discoverability, product detail page performance, etc. across platforms and geographies helps brand to stay ahead of the competition and leverage data-driven decisions.

- Pricing & Discount Trends – Real-time price tracker and comprehensive competitive analysis can help brand set dynamic pricing to ace the game on quick commerce and e-commerce platforms.

- Availability Monitoring – Keep Track of your stock availability across platforms and geographies at a granular level. Going out-of-stock can push your product into highly competitive marketplaces and platforms and lose brand credibility.

- Content Analysis (Perfect page analysis) – Keep your product detail page title, description, product images of high quality and optimized can give a massive boost to visibility. On Quick commerce platform, it is mostly about the product title that it should pop up when searched.

- Digal Share of Shelf Monitoring – Key track of your share of search and presence on the digital shelf. Product discoverability is key to staying ahead of the competitors across the digital marketplaces.

- Sponsored Banners Performance – Sponsored listing on e-commerce and quick commerce platforms is critical to reach the right audience. Automate the process of sponsored ad spend and bidding process to ensure your budget gets optimized not wasted.

Case Study: Monitoring Availability across Q-com platforms

Objective & Problem Statement: One of the biggest multinational F&B conglomerates wanted to measure, track and grow platform presence and stock availability in the AMESA region. They were already working with an ecommerce intelligence tool but suffered due to limited scaling capability and platform coverage. Moreover, they were not able to customize data insights for the brand.

mFilterIt Deployment: The F&B conglomerate had deployed mFilterIt e-commerce intelligence stack for its presence on all e-commerce and quick commerce platforms in the region. They monitored the products across multiple KPIs across the Middle East & North Africa region. In the UAE region they mainly focused on enhancing its market presence with monitoring availability and optimizing share of search.

mFilterIt Analysis & Inferences: In the UAE they focused on optimizing availability on key platforms Careem, Carrefour, Noon and Talabat for Beverages, Nutritious Food and Snack category.

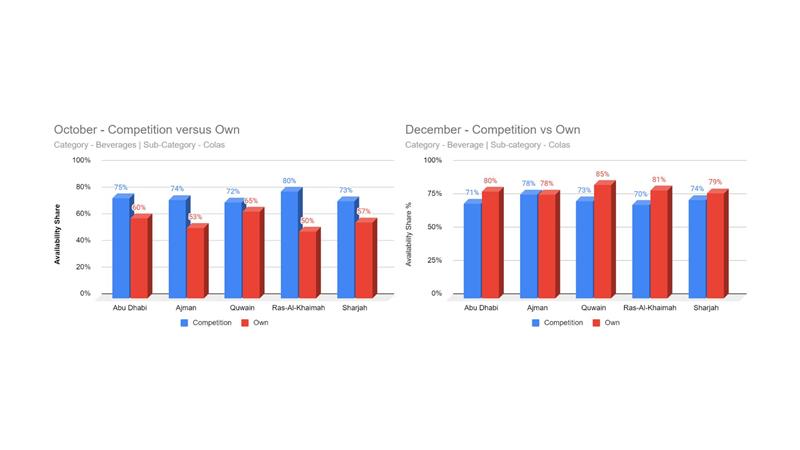

Fig. 1: Before and after using mScanIt last year at multiple locations on Q-commerce platforms

They identified and acted on performance gaps with global dashboard monitoring availability and other core KPIs. With limited availability and platform presence they were losing out on sales. As they started tracking zip-code wise availabilities, the internal teams could be activated for improved performance in every region. This led them to optimize availability versus competition across platforms and geographies on various categories and sub-categories. With growth of around 41% in availability share across platforms the brand expanded its presence and reached the shoppers.

The first checkpoint on optimizing the customers is staying in the race – prevent stock out. The brand grows availability at the dark store level to make sure the availability doesn’t fall behind the competition. A momentary lapse in availability can lead to losing a potential customer. Frequent stock-outs also affect brand reputation and loss of revenue.

They monitored the products across multiple KPIs across the Middle East & North Africa region. In the UAE region they mainly focused on enhancing its market presence with monitoring availability and optimizing share of search.

Monitoring stock availability at the dark stores gives the brand an added edge over the competition across platforms. This intelligence also enables brands to re-stock on time and identify the demand across locations. The ability to identify and plug the availability gaps helps make data-driven decisions to optimize performance and ensure that their products are consistently accessible to the shoppers.

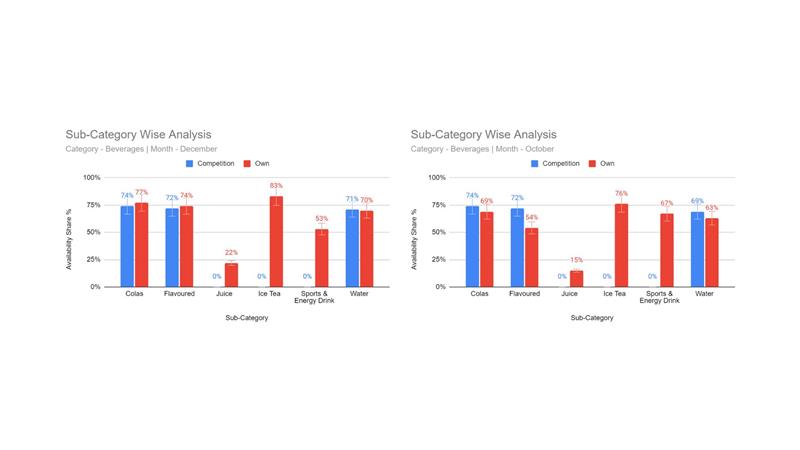

Fig. 2: Sub-category wise analysis before and after mScanIt last year

The F&B brand was given detailed insights across e-commerce platforms and quick commerce to optimize the customer journey. The competitive insights and intelligence must include:

- Brand Availability Trends

- Availability share versus competition

- City-Wise Availability Trends/Lat-long Analysis

- Platform-wise & geography-wise analysis

- Insights that help identify geography to target

- Out-of-Stock product lists & alerts

The real-time data updates and insights enabled the brands to adapt swiftly to market dynamics and consumer demands. Furthermore, the focus on optimizing product page content and overall product performance on e-commerce and quick commerce platforms enhance customer experience, product discoverability and online presence.

Conclusion

The United Arab Emirates has a strong and growing economy, which has created a large consumer market for Quick Commerce companies to tap into. Additionally, the government has been supportive of the development of the Quick Commerce market, which has helped to create a favorable regulatory environment.

However, the fierce competition means brands need to be on their toes to stay ahead across platforms be it quick commerce or e-commerce marketplace with mScanIt digital commerce intelligence. Our quick commerce analytics tool ensures real-time monitoring across platforms on multiple KPIs covers a wide assortment of SKUs.

Get in touch to know more about Quick Commerce.